Debt Free Life

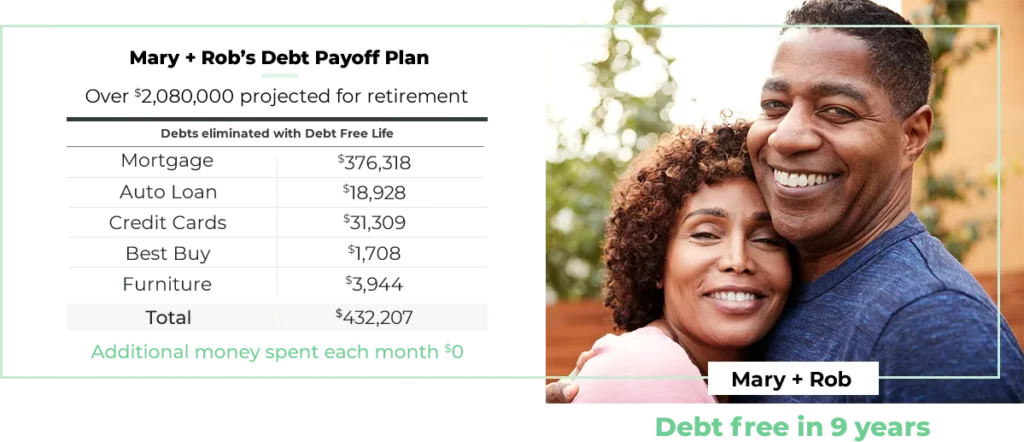

Eliminate your debt in nine years or less without spending any additional money.

What is Debt Free Life® ?

Debt Free Life is an insurance solution that builds a cash value over time. As your cash value grows, you can eliminate all your debt incrementally and save the balance for retirement – without spending any additional money. With Debt Free Life, you can create a long-lasting legacy for your family by achieving financial freedom and

retiring with tax-favored income.

With Debt Free Life®, you can kick debt to the curb and rewrite your story.

The Debt Free Life® Solution

Our proven method has helped thousands of families get on track to financial freedom while building a legacy with real retirement savings.

How to Get Started

Step 1

Schedule an appointment with a Debt Free Life consultant either in-person or over a video consultation.

Step 2

Your consultant will guide

you through a financial

worksheet, highlighting

areas of opportunity for

increased cash flow.

Step 3

Eliminate your debt with

the guidance of your

consultant using the

proven Debt Free Life

solution.

The Debt Free Life® Solution

Debt Free Life helps you eliminate specific debts incrementally.

Find out today what a Debt Free Life plan could do for you.

Debt Free Life® Testimonials

Luke + Jennifer

Before Debt Free Life, Luke

and Jennifer were in debt for

22.5 years. Now they will be

debt free in 7 years.

Alejandra

With Debt Free Life, Alejandra

will save over $100,000

in interest and become debt free

in 3.6 years.

The Dillworths

Thanks to Debt Free Life, the

Dillworths will eliminate their

debt in 6.5 years and save over

$108,000 in interest.

Frequently Asked Questions

What are the advantages of Debt Free Life?

The top advantage of Debt Free Life is the financial freedom you get from being debt free. By paying off all of your debt in nine years or less, you will begin saving for the retirement you deserve. Through our unique offerings, you’ll reduce the volume of interest you are paying to lenders, decrease taxes and retire with tax-favored income.

Can I afford Debt Free Life?

Yes! Debt Free Life allows you to accomplish your financial goals, eliminate debt, and save for retirement without spending any additional money than you are currently spending. The question is not can you afford this program, rather, can you afford to delay getting started?

When should I implement Debt Free Life?

As soon as you can! The earlier you begin your journey to financial freedom, the greater results you will see. A Diaz Legacy Debt Free Life consultant is ready to help you – let’s get started!

I am a business owner. Can I get my business out of debt with Debt Free Life?

Absolutely! Our consultants can apply Debt Free Life to your business and build cash value while eliminating debt and decreasing the amount of interest paid to lenders.

Debt Free Life® Resources

DEBT FREE LIFE

Benefits of Being Debt Free

Beyond financial confidence, there are many benefits to living a debt free life.

DEBT FREE LIFE

Managing Debt During COVID-19

Get some tips for managing your budget + learn how Debt Free Life can help.

DEBT FREE LIFE

How Debt Free Life Works

Learn how the Debt Free Life plan can help you pay off debt + save for retirement.

Get out of debt and take control of your financial future. Connect with a Debt Free Life® consultant today.